Benefits

Leave

Leave Policy

Employee Navigator

Benefits enrollments are handled through Employee Navigator.

Benefits can be changed, added, or dropped during open enrollment.

Beneficiaries can be updated at any time. Individual enrollment summaries can also be viewed at any time by logging in.

Benefits Summary

Medical Insurance

Medical Insurance

Emery County School District offers health insurance to eligible employees through the STAR HSA Plan offered by PEHP Health. All plans offered are high deductible plans with an accompanying Health Savings Account (HSA). Details of this benefit can be found by accessing the files below.

PEHP Health & Benfits

560 East 200 South

Salt Lake City, UT 84102

(801) 366-7555 (Customer Service)

(801) 366-7755 (Preauthorization)

Files

PEHP Benefits Overview

Plan & Benefits Handbook

Policies

Health Savings Account

Health Savings Account

Employees with District-sponsored medical insurance through PEHP Health & Benefits will have an accompanying Health Savings Account (HSA). The HSA account belongs to the employee and is administered by AxisPlus Benefits. Employees are issued a debit card that can be used to pay for qualifying medical expenses. Employees can also submit receipts to AxisPlus for reimbursement.

Emery School District deposits an amount in the qualifying employee's HSA each year. The amount is determined based on three factors

1) Full or part-time status of the employee

2) The plan design the employee chooses (Option 2 (District Sponsored Plan), Option 1 (buy-up) or Option 3 (buy-down)

3) The number of people insured by the employee's plan (Family, 2-Person, Individual)

Employees can contact the Business Office for specific questions about their HSA.

AxisPlus Benefits

860 East 9085 South

Sandy, UT 84094

Phone: (877) 872-2125

Email: info@myaxisplus.com

Medical Insurance Waiver

Medical Insurance Waiver

Qualifying employees can waive their health insurance benefit with the District and receive an in-lieu-of stipend. See the documents below for more information about this program.

Files

Health Insurance Waiver Application

Policies

Pharmacy

Pharmacy

Employees with health insurance through PEHP Health &Benefits have a pharmacy benefit. Prescriptions can be filled at most pharmacies nationwide. The pharmacy benefit includes a home delivery service through Express Scripts.

For retail pharmacy prescriptions, employees pay the full price of prescriptions, until the annual deductible has been met. Once the deductible is met, prescriptions are covered at 10% / 30% / 50% until the annual out-of-pocket maximum is met. If the annual out-of-pocket maximum is met, prescriptions are covered at 100% for the plan year, thereafter.

For mail-order (90 day) prescriptions, employees pay the full price of prescriptions, until the annual deductible and out-of-pocket maximums have been met, as explained above. Prescriptions are covered at 100% thereafter. Mail order prescriptions are available through Express Scripts. Employees must use a participating pharmacy. A weblink to participating pharmacies is above. Employees may also fill 90 day prescriptions through a special arrangement with Boyd's Pharmacy in Castle Dale. Contact Boyd's Pharmacy if you are interested.

Dental

Dental Insurance

Emery County School District offers dental insurance to qualifying employees through PEHP Health & Benefits. Details of this benefit can be found by accessing the links below.

PEHP Health & Benfits

560 East 200 South

Salt Lake City, UT 84102

(801) 366-7555 (Customer Service)

(801) 366-7755 (Preauthorization)

Website

Files

Dental Plan Summary

Dental Plan Handbook

Policies

Vision

Vision

Eligible employees can purchase vision insurance with EyeMed Vision Care via payroll deduction. This is a voluntary benefit and the employee pays 100% of the premium. Two plans are available, each with coverage for individual, two-party and family situations.

Enrollment is only available during the annual open-enrollment period (August - September). More information is available below.

EyeMed

Forms

Enrollment Form

Utah Retirement Systems: Pension

Retirement (Pension)

Eligible employees are enrolled in the appropriate pension program with Utah State Retirement Systems. Eligible employees who began their employment prior to July 1, 2011 belong to the Tier 1 pension program. Eligible employees who began their employment on or after July 1, 2011 belong to the Tier 2 retirement program. Eligibility is explained in the fringe benefits policies listed below. Educational brochures for both programs are provided on the URS website, with a link below.

The pension programs are SEPARATE from the 401(k), 457 or other investments accounts you may have with URS.

Please view the links and files below for more information.

Utah Retirement Systems

560 East 200 South

Salt Lake City, UT 84102-2099

(801) 366-7770

(800) 695-4877 toll free

Links

URS Pension Brochures & Publications

Policies

Utah Retirement Systems: 401K & Retirement Savings

Retirement (Non-Pension):

Employees who are eligible for participation in the Utah Retirement Systems (URS) pension program are automatically enrolled in a 401(k) account with URS. The District pays the equivalent of 1.5% of eligible wages into this account each month. Eligible employees can also contribute into their 401(k) account through payroll deduction. The 401(k) is an investment account and values change on a daily basis. Employees have total control over the investment options their money is placed in. Investment options can be changed online or by form.

Through URS, eligible employees also have the option of opening other retirement accounts, including a 457 account, a Roth IRA and a Traditional IRA. Contributions to these accounts are also made through payroll deduction and investment options are controlled by the employee.

A separate set of laws and regulations governs each plan. For more information on plan design and investment options, view the links and files attached below or contact URS directly.

Utah Retirement Systems

560 East 200 South

Salt Lake City, UT 84102-2099

(801) 366-7720

(800) 688-4015 toll-free

Links

Social Security

View More

View MoreSocial Security

Emery County School District is a participating employer in the Social Security program. The District pays 6.2% of employee wages for Social Security and 1.45% of employee wages for Medicare. Employees also contribute the same percentage of wages, which are taken as deductions on paychecks.

From the Social Security website: "As you work and pay taxes, you earn Social Security credits. In 2019, you earn one credit for each $1,360 in earnings—up to a maximum of four credits per year. Most people need 40 credits (10 years of work) to qualify for benefits."

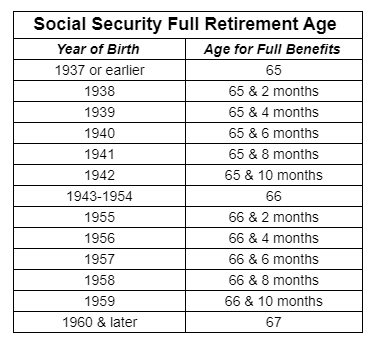

To receive maximum benefits, employees must wait until they reach full retirement age (shown below in the chart) for Social Security. "You can retire at any time between age 62 and full retirement age. However, if you start benefits early, your benefits are reduced a fraction of a percent for each month before your full retirement age."

From the Social Security website: "Social Security was never meant to be the only source of income for people when they retire. Social Security replaces about 40 percent of an average wage earner’s income after retiring, and most financial advisors say retirees will need 70 percent or more of pre-retirement earnings to live comfortably. To have a comfortable retirement, Americans need much more than just Social Security. They also need private pensions, savings and investments."

Employees who may be eligible for benefits through Social Security are responsible to inquire about and apply for these benefits on their own. The District does not apply for or administer any Social Security benefits. The links and webpages listed below include important information for employees interested in finding out more about Social Security.

Files

Overview of Social Security Benefits

How You Earn Social Security Credits

Links

Savings

Savings

Employees of Emery School District can have payroll deductions sent directly to their savings accounts. The District does not sponsor or endorse savings accounts through any particular bank or plan. Currently, the District allows savings payroll deduction for savings accounts with the following institutions / plans:

- Desertview Credit Union

- Utah Power Credit Union

- Utah Educational Savings Plan (UESP)

To set up a payroll deduction, employees need to open an account with the credit union or UESP, then come into the Business Office with the account number and sign up. This can be done at any time of the year and deductions will begin on the next payroll run.

Payroll deductions may be considered for another financial institution / plan if there are sufficient interested employees to justify it.

For more information on savings accounts, please contact the financial institution or plan you are interested in. Questions about payroll deductions can be answered by calling the District payroll specialist.

403b

403(b) Savings

Eligible School District employees can contribute to a 403(b) account. This is a tax-advantaged retirement savings plan, very similar to a 401(k). Emery School District does not endorse any particular vendor of 403(b) plans; however, there are many vendors through which employees can open an account. Employees currently have accounts with the following vendors:

- AIG (Valic)

- AIG (Sun America Life)

- AILIC

- Americo Financial Life

- Horace Mann

- ING

- Life Insurance of the Southwest

- Primerica

- VFS Financial Services

The District has signed on with National Benefit Services (NBS) for 403(b) plan administration services. NBS ensures compliance with all Federal 403(b) regulations. Regardless of the vendor, all 403(b) account registration, modification and/or closure must go through NBS.

If you are interested in signing up for a 403(b) account, please contact the District benefits specialist for more information. Links with useful information are also provided below.

National Benefit Service, LLC

8523 S. Redwood Road

West Jordan, UT 84088

(800) 274-0503, Ext. 5

(800) 597-8206 (Fax)

Flex Spending

How Much Can I Save?

How Much Can I Save?Flexible Spending

The flexible spending program provides a means for employees to set aside a portion of their income on a pre-tax basis to pay for medically related expenses. This program is administered by the Utah School Boards Association. Participating employees pay a $2.00 per month fee. A debit card option is also available for an additional $4.00 per month.

Employees with medical insurance through the District, who have a Health Savings Account (HSA), are only eligible to participate in a limited purpose Flex Spending account. For more information, contact the Business Office.

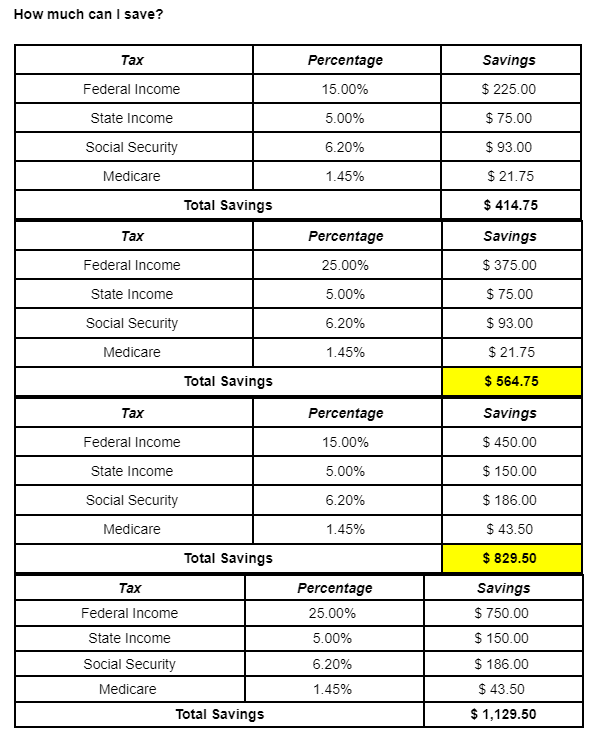

The savings available through this program are significant. As a general rule, you can expect to save between 25% and 40% of the amount you put into your flex account each year. A maximum of $5,000 of income can be set aside per year. See examples below of how you save through the flex program (based on the federal income tax bracket you qualify for and how much you set aside in the flex program per year).

AxisPlus Benefits

860 East 9085 South

Sandy, UT 84094

Phone: (877) 872-2125

Email: info@myaxisplus.com

Life Insurance

Life Insurance

Emery School District offers a $50,000 District-paid life insurance policy to eligible employees. This policy also includes $10,000 of coverage for spouses and dependents. Qualifying employees can also purchase supplemental life insurance in increments of $5,000, from a minimum of $20,000 to a maximum of $300,000. Supplemental coverage can also be purchased for spouses and dependents. Eligibility is explained in the District Fringe Benefits policies.

Eligible employees can enroll for supplemental coverage without evidence of insurability only at hire. Later enrollment requests are subject to evidence of insurability, including a medical examination. Eligible employees can also sign up for a voluntary AD&D (Accidental Death & Dismemberment) policy. Employees may sign up at any time. The application and information sheets are in the files section. For more information, contact the District Benefits Specialist.

Hartford Life & Accident Insurance Company

P.O. Box 2999

Hartford, CT 06104-1124

(866) 460-1855 Ext 3343 toll-free

Enrollment Form / Beneficiary Designation

Policies

Long Term DIsability

Long-Term Disability

Emery School District offers optional Long-Term Disability insurance to eligible employees. This insurance is offered to qualifying employees on a cost-sharing basis. The District pays 50% of the premium (0.191% of wages) and the employee pays the other 50% (0.191% of wages) through a payroll deduction.

Long-Term Disability insurance provides up to 67% of employee wages prior to disablement, after social security and other benefits. There is an elimination period of 120 days, meaning that the employee must be disabled for 120 days before benefits can begin.

Employees need to sign up for LTD insurance within 31 days of being hired. For more information, contact the District Benefits Specialist.

Hartford Life & Accident Insurance Company

P.O. Box 2999

Hartford, CT 06104-1124

(866) 460-1855 Ext 3343 toll-free

Longevity Benefit

Longevity Benefit

Eligible employees who work for Emery School District for over 15 years (with the last 10 years being consecutive) become eligible for longevity benefits. Qualifying employees receive an annual benefit, typically paid in June, for each year of service subsequently completed. The benefit is paid through the District's Prime-Choice plan and goes into either an interest-bearing medical savings account or the employee's 401(k) account through Utah Retirement Systems.

Pelion Benefits is the administrator of medical savings accounts for the program. Once employees retire, qualifying medical expenses can be reimbursed by sending a reimbursement request and accompanying documentation to Pelion. The process is very similar to requesting reimbursement from a flexible spending account. The money in the Pelion account stays with the employee until used (there is no "use it or lose it" clause).

The annual benefit amount is equal to a base of $1,000 plus an add-on amount of 0.30% of the employee's base salary. This amount is pro-rated for less than full-time employees. For a full description of this program, please refer to the District policy link.

Utah Retirement Systems

560 East 200 South

Salt Lake City, UT 84102-2099

(801) 366-7720

(800) 688-4015 toll-free

Pelion Benefits, Inc

1414 Raleigh Road, Suite 405

Chapel Hill, NC 27517

(984) 219-2548

Policies

Workers Compensation

Workers Compensation

Emery School District provides Workers Compensation Insurance through the Utah School Boards Risk Management Mutual Insurance Association. The purpose of this insurance is to cover medical costs and lost wages for on-the-job accidents. If an employee has an on-the-job accident, the following steps should be taken:

1) If the injury is life threatening, the employee should immediately be taken to the nearest medical facility. Once stabilized, the employee should contact Company Nurse (phone number below) to report the injury. Company Nurse will direct the initial medical care received by the employee.

2) If the injury is not life-threatening, the employee should first contact their supervisor to report the injury. The employee should then immediately contact Company Nurse (phone number above) to report the injury. Company Nurse will then direct the initial medical care received by the employee.

3) The supervisor should contact the District Business Office to report the injury and forward any documentation.

4) The District Business Office will file a worker's compensation claim with USBA Risk Management. An adjuster will be assigned to the claim, and the employee will be notified of the contact information of their adjuster. From this point, it is the responsibility of the employee to work closely with their adjuster throughout the course of the claim.

For more information, please contact the Business Office at (435) 687-9846.

Utah School Boards Risk Management Mutual Insurance Association

860 East 9085 South

Sandy, UT 84094

(801) 569-3632

Company Nurse

(888) 375-0279

Computer Loan

Computer Loan

Eligible employees can apply for an interest-free loan from the District for the purpose of purchasing one home computer or similar device and accompanying equipment and/or software. Loans may be made for a device with similar functionality to that of a computer at the discretion of the Business Administrator. Loans are made up to a maximum of $2,400 and not more often than once every 24 months per employee.

Eligible employees can purchase a computer/device and software/equipment for this program through any reputable vendor. The purchase receipts should be brought to the Business Office at which time a loan document will be written up and signed. A check for the amount of the loan will then be made out to the employee during the next accounts payable check run (usually each Thursday, but subject to change). Employees can use this check to pay off the original purchase.

Repayment through payroll deduction will begin on the next end-of-month check. A minimum of $100 per month is deducted although employees can elect to have a higher amount deducted. Full pay off can be made at any time. Employees with questions should contact the District Business Administrator or Accounts Payable Specialist

Policies

Employee Assistance (EAP)

Employee Assistance Program (EAP)

Eligible employees have access to counseling services through Four Corners. These services include: legal, marriage, family, financial and psychological. Services are paid for by the District through a contracted annual fee; however, the services are completely confidential. Up to three (3) counseling sessions per condition are available through this service.

Eligible employees utilizing this benefit should contact Four Corners directly and mention that the services are to be performed under the Employee Assistance Program contract with the School District.

Four Corners Behavioral Health (Emery)

45 East 100 South, Castle Dale

(435) 381-2432

Four Corners Behavioral Health (Carbon)

575 East 100 South, Price

(435) 637-2358

Legal Liability Insurance

Legal Liability Insurance

Legal coverage is provided to employees through the Utah State Division of Risk Management. Coverage includes civil claims or lawsuits brought against employees for acts or omissions occurring during the performance of duties or within the scope of employment. See the brochure below for more information.

Utah State Division of Risk Management

5120 State Office Building

Salt Lake City, UT 84114

(801) 538-9560

Files